-

Table of Contents

- Introduction

- How to Downsize Your Home for Retirement: Tips and Strategies

- How to Make the Most of Your Retirement Savings by Downsizing

- The Benefits of Downsizing in Retirement: Financial and Emotional

- How to Find the Right Retirement Home for Downsizing

- How to Prepare for Downsizing in Retirement: A Step-by-Step Guide

- Conclusion

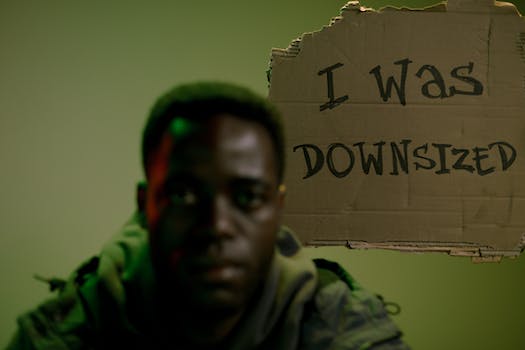

“Downsizing in Retirement: A Practical Guide – Unlock the Benefits of a Simpler Life!”

Introduction

Downsizing in Retirement: A Practical Guide is a comprehensive guide to help retirees make the most of their retirement years. It provides practical advice on how to downsize your lifestyle, manage your finances, and make the most of your retirement years. This guide covers topics such as budgeting, investing, and estate planning, as well as how to make the most of your retirement years. It also provides tips on how to make the most of your retirement years, such as how to stay active and engaged in your community. With this guide, you can make the most of your retirement years and enjoy a comfortable and secure retirement.

How to Downsize Your Home for Retirement: Tips and Strategies

Retirement is a time to enjoy the fruits of your labor and relax. But if you’re like many retirees, you may be looking to downsize your home to save money and simplify your life. Downsizing can be a great way to reduce your expenses and free up more time for leisure activities. Here are some tips and strategies to help you downsize your home for retirement.

1. Start Early: Downsizing your home is a big undertaking, so it’s best to start early. Begin by assessing your current home and making a list of what you need and what you don’t need. This will help you determine what items you can get rid of and what items you should keep.

2. Set a Budget: Before you start looking for a new home, set a budget. Consider your current income and expenses, as well as any additional income you may receive in retirement. This will help you determine how much you can afford to spend on a new home.

3. Consider Your Needs: When downsizing, it’s important to consider your needs. Think about what features are important to you and what you can live without. This will help you narrow down your search and find a home that meets your needs.

4. Research Your Options: Once you’ve determined your budget and needs, it’s time to start researching your options. Look into different types of homes, such as condos, townhouses, and single-family homes. Consider the pros and cons of each option and decide which one is best for you.

5. Get Professional Help: Downsizing can be overwhelming, so it’s a good idea to get professional help. Consider hiring a real estate agent to help you find the perfect home. They can also provide valuable advice and guidance throughout the process.

Downsizing your home for retirement can be a great way to save money and simplify your life. By following these tips and strategies, you can make the process easier and find the perfect home for your retirement.

How to Make the Most of Your Retirement Savings by Downsizing

Retirement is a time to enjoy the fruits of your labor and relax after a lifetime of hard work. However, it can also be a time of financial stress if you haven’t saved enough for your golden years. Downsizing can be a great way to make the most of your retirement savings and ensure that you have enough money to live comfortably.

Downsizing can take many forms, from selling your home and moving to a smaller one to cutting back on unnecessary expenses. Here are some tips to help you make the most of your retirement savings by downsizing:

1. Sell Your Home: Selling your home and moving to a smaller one can be a great way to free up some extra cash for retirement. Consider selling your home and using the proceeds to purchase a smaller, more affordable home. This will help you save money on mortgage payments and other expenses associated with owning a home.

2. Cut Back on Unnecessary Expenses: Take a look at your budget and identify any unnecessary expenses that you can cut back on. This could include things like eating out, entertainment, and other luxury items. By cutting back on these expenses, you can free up more money for retirement savings.

3. Consider Renting: If you’re not ready to sell your home, consider renting it out. This can be a great way to generate extra income that can be used to supplement your retirement savings.

4. Invest Wisely: Investing your retirement savings wisely can help you make the most of your money. Consider investing in low-risk investments such as bonds and mutual funds. This will help you maximize your returns while minimizing your risk.

Downsizing can be a great way to make the most of your retirement savings. By selling your home, cutting back on unnecessary expenses, and investing wisely, you can ensure that you have enough money to live comfortably during your golden years.

The Benefits of Downsizing in Retirement: Financial and Emotional

Retirement is a time of life when many people look to downsize their living arrangements. Downsizing can provide a number of financial and emotional benefits that can help retirees enjoy their golden years.

Financial Benefits

One of the most obvious financial benefits of downsizing in retirement is the cost savings. Moving to a smaller home or apartment can significantly reduce monthly housing costs. This can free up money for other expenses, such as travel or leisure activities. Additionally, downsizing can reduce the amount of money spent on utilities, maintenance, and repairs.

Downsizing can also provide financial benefits in the form of tax savings. Many states offer tax incentives for seniors who downsize, such as property tax exemptions or credits. Additionally, selling a larger home and buying a smaller one can result in a lower capital gains tax bill.

Emotional Benefits

Downsizing in retirement can also provide emotional benefits. Moving to a smaller home can reduce the amount of time spent on cleaning and maintenance, freeing up time for leisure activities. Additionally, downsizing can reduce the amount of clutter in the home, which can help reduce stress and anxiety.

Downsizing can also provide a sense of freedom and independence. Moving to a smaller home can give retirees the opportunity to live in a more manageable space, allowing them to enjoy their retirement years without the burden of a large home.

Overall, downsizing in retirement can provide a number of financial and emotional benefits. Retirees who are considering downsizing should weigh the pros and cons carefully to determine if it is the right decision for them.

How to Find the Right Retirement Home for Downsizing

Downsizing in retirement can be a difficult decision, but it can also be a great way to simplify your life and save money. Finding the right retirement home for your needs can be a challenge, but with a little research and planning, you can find the perfect place to call home. Here are some tips to help you find the right retirement home for downsizing.

1. Consider Your Needs: Before you start looking for a retirement home, take some time to think about your needs. What type of lifestyle do you want? Do you need a place with lots of amenities or something more basic? Are you looking for a community with other retirees or a more private setting? Knowing what you need will help you narrow down your search.

2. Research Your Options: Once you know what you’re looking for, it’s time to start researching your options. Look for retirement homes in your area that meet your needs. Read reviews online and talk to people who have lived in the homes you’re considering. This will help you get a better idea of what to expect.

3. Visit the Homes: Once you’ve narrowed down your list, it’s time to visit the homes in person. Take a tour of the facilities and ask questions about the amenities, services, and activities available. Make sure the home is a good fit for your lifestyle and budget.

4. Ask About Financing: Retirement homes can be expensive, so it’s important to ask about financing options. Many homes offer financing plans or discounts for seniors. Make sure you understand all the details before signing any contracts.

Finding the right retirement home for downsizing can be a challenge, but with a little research and planning, you can find the perfect place to call home. Consider your needs, research your options, visit the homes, and ask about financing to make sure you find the right retirement home for you.

How to Prepare for Downsizing in Retirement: A Step-by-Step Guide

Retirement is a time of transition, and for many, it means downsizing. Whether you’re looking to move to a smaller home, downsize your possessions, or both, it’s important to plan ahead. Here’s a step-by-step guide to help you prepare for downsizing in retirement.

1. Assess Your Needs: Before you start downsizing, take a look at your current lifestyle and needs. Consider how much space you need, what type of home you’d like to live in, and what amenities you’d like to have.

2. Set a Budget: Once you’ve assessed your needs, it’s time to set a budget. Consider your income, expenses, and any other financial obligations you may have. This will help you determine how much you can afford to spend on a new home.

3. Research Your Options: Now that you have a budget in mind, it’s time to start researching your options. Look into different types of homes, neighborhoods, and amenities. Consider what type of lifestyle you’d like to have and what type of home would best suit your needs.

4. Make a List of Must-Haves: Once you’ve narrowed down your options, make a list of must-haves. This will help you focus on the features that are most important to you and make sure you don’t overlook anything.

5. Start Downsizing: Now that you’ve done your research and made a list of must-haves, it’s time to start downsizing. Start by sorting through your possessions and deciding what to keep and what to get rid of. Consider donating or selling items that you no longer need or use.

6. Find a New Home: Once you’ve downsized, it’s time to start looking for a new home. Consider your budget, needs, and must-haves when searching for a new place.

7. Make the Move: Once you’ve found the perfect home, it’s time to make the move. Start by packing up your belongings and arranging for movers. Then, it’s time to settle into your new home and enjoy your retirement.

Downsizing in retirement can be a daunting task, but with the right preparation and planning, it can be a smooth and stress-free process. Use this step-by-step guide to help you prepare for downsizing in retirement and make the transition as easy as possible.

Conclusion

In conclusion, Downsizing in Retirement: A Practical Guide is an invaluable resource for anyone looking to make the most of their retirement. It provides a comprehensive overview of the downsizing process, from understanding the financial implications to finding the right home. With its step-by-step approach and helpful tips, this guide is sure to help retirees make the most of their retirement and enjoy a comfortable lifestyle.